Nowadays, the last thing you think when you hear about ‘innovation’ is a suit-wearing executive. We’ve come to think tech and fresh business models belong exclusively to VC-funded start-ups. The corporate world, we’re told, is stale and stodgy.

Don’t believe the hype. I’ve worked in corporates for many years in companies with thousands of employees and decades of history. Yet every time, I’ve found opportunities to build startups internally.

If you’re finding yourself motivated to lead a start-up within a large corporation – I want you to know it’s possible. I’ve written this article as a practical guide for ambitious financial-services leaders, looking to breed innovation from within.

True, the ability to build something new in a large organization can be complex. But it comes with some serious advantages. Incumbent financial services companies have assets built over decades – centuries sometimes! They’ve got clients; sales funnels; strong balance sheets. Even their regulatory checks and balances (which new entrants often see as dead weight) allow them to move faster in a highly regulated field.

Generali Insurance Group, for example, is the world’s 6th largest insurer. They have over 150,000 agents, serving a huge client base. Many would believe that steering such a large ship towards innovation would be impossible. But, when serving as their head of digital transformation, my thought was:

If we get this right, it'll be much bigger than a start-up.

Mindset is the main stumbling block for internal digital innovation, I’ve found. Financial services companies, particularly insurance companies, are risk-mitigation experts. It’s in their DNA to manage risk – not opportunity.

The biggest catalyst for internal innovation is embracing a portfolio-management approach. It means accepting as a given that some of your experiments will fail. The right strategy is to test ideas in parallel and push forward on the successes.

There are three crucial steps to achieve this in practice:

1. From Egosystem to Ecosystem

Financial services giants aren’t known for their appetite to collaborate. With large balance sheets (and large egos to match), the industry mindset has typically been to buy capabilities to own in-house.

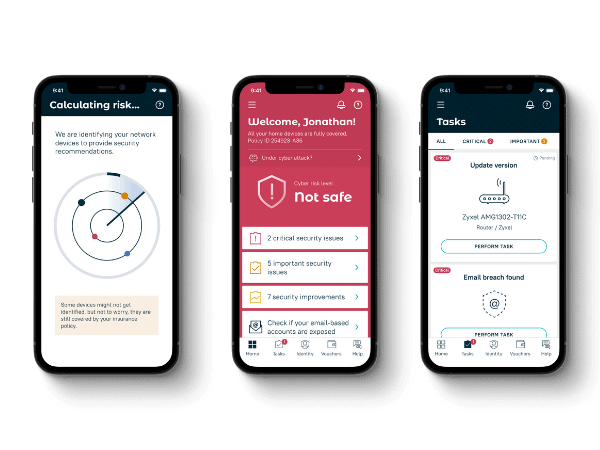

But owning the entire value-chain falls apart when it comes to digitization. Instead, the real opportunity lies is in partnerships with FinTechs. It enables internal innovators to quickly build a Proof of Concept (PoC) solution and test it. If unsuccessful, you can move on quickly; but when it works, the upside is huge.

Having followed this blueprint within large corporations, I later founded Axell, to help even more financial services businesses leverage their immense assets to innovate, by partnering with specialist FinTech firms who would help them iterate faster.

For example, here are three real-life case studies of our work with wealth managers that have partnered with FinTechs to create solutions with direct bottom-line impact.

2. Practice Human-Centred Design

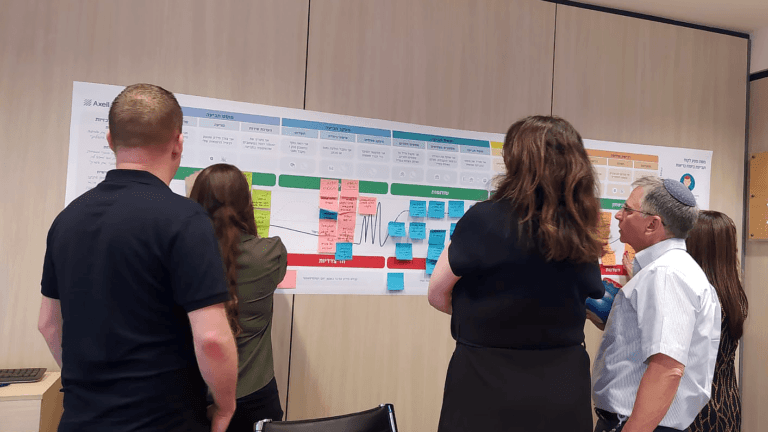

In large companies, different teams are often convinced their needs demand a bespoke approach. The great challenge is to bring them together into a single, unified solution.

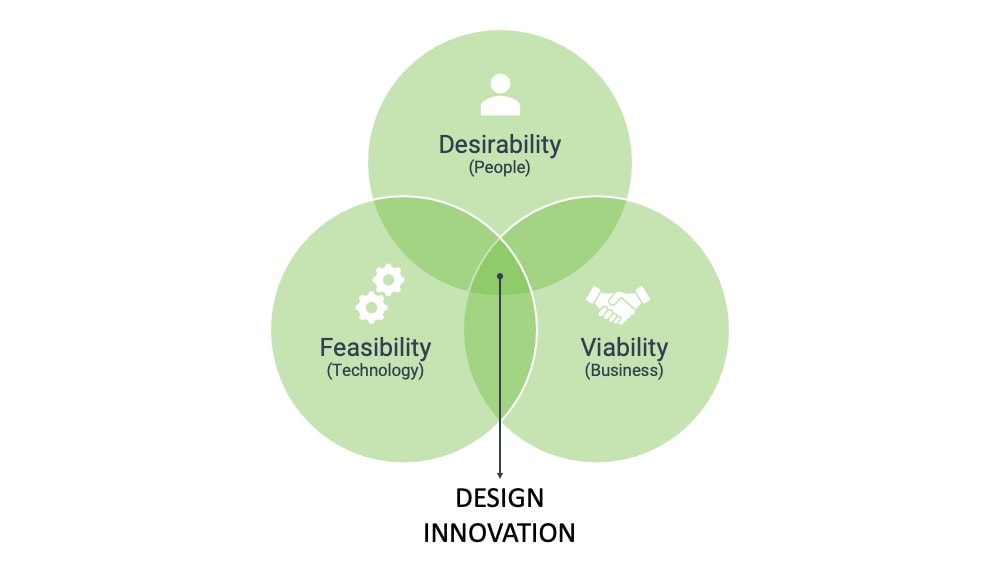

I subscribe to the human-centred design methodology. It brings together teams into a single, unified solution. It’s done by combining design with technology and data:

- From the outset, collecting insights and data on what the customer wants is crucial.

- To make it viable, cross-department collaboration has to be there at the outset – your product dies without it.

- Finally, it’s about becoming aware of what current technology has to offer.

One recent example has been a large auto-insurer who’s introduced an entirely new product for young drivers, and has been seeing fantastic commercial adoption.

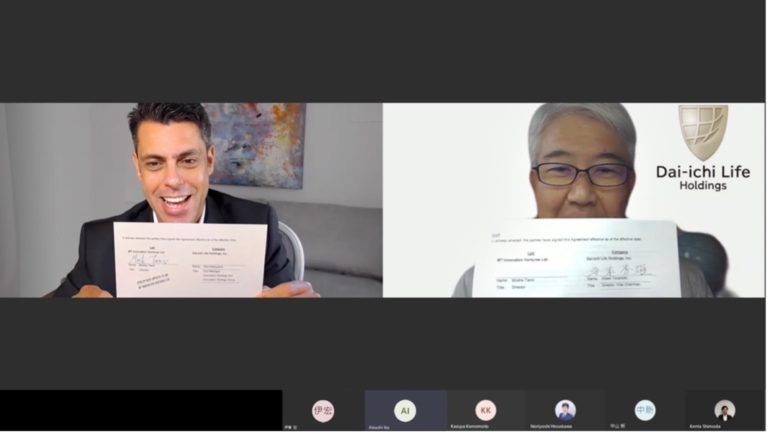

3. Building strategic alliances

Partnering early with the right innovators is a cornerstone of any internal innovation effort. Success hinges on bringing together management and stakeholders. This is done by communicating the value and payoff in taking controlled risks.

Most recently at Axell, we’ve been applying this process to support Dai-ichi Life, Japan’s third-largest insurer. With over 30 million policies globally and over 50,000 financial agents, this is not a project a company like Dai-ichi would enter lightly. Its capacity to embrace new solutions is built through deep internal stakeholder management.

Final thoughts

Companies are so geared to minimize downsides they can forget to consider the upside. It takes someone who’s willing to manage opportunities – not risks – to deliver change.

I’ve been very lucky to have had the opportunity to be an entrepreneur within large organizations. And, having been at it for over two decades, I feel the time has never been better to innovate from within. Large corporates, even in financial services, are starting to catch up. Properly utilized, their existing capabilities actually make it easier.

Use Cases - Innovation in action

To see Axell’s innovation methodology come to life, explore our library of use cases.