I had the privilege of addressing Dai ichi Life’s top executives in Tokyo, Japan, where I discussed the pivotal future trends impacting insurance distribution. Throughout my professional journey, I’ve led transformative digital programs within leading corporate insurance companies. Today, as the CEO & Founder of Axell, I collaborate with international insurers to expedite their innovation endeavors. My passion lies in distribution, an area fraught with challenges and opportunities, which I’ve seen in industries around the world.

What are the challenges?

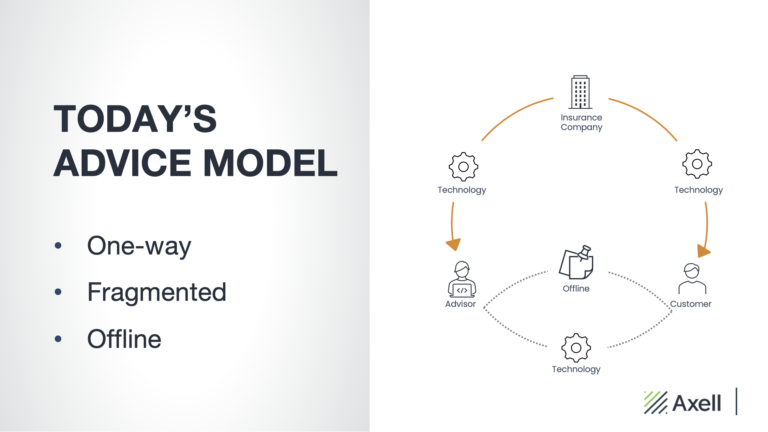

While corporate insurers have established distribution channels, enviable customer bases, and strong brands, new digital newcomers are threatening new business. There are 3 main challenges:

- Advisors and agents are leaving the industry – unable to meet sales targets while servicing existing clients, bans on commissions and a lack of training and support are resulting in industry attrition.

- Regulatory pressures are stifling growth – new competitors are not constrained by the same legacy technology and bureaucratic processes that subject traditional insurers to regulatory scrutiny; ultimately, detracting from growth-focused initiatives.

- Customer loyalty is under threat – new generations are demanding more value and a better experience from their insurers and are prepared to switch to get the best deal.

Underpinning all these challenges is a lack of digital processes to adapt with agility to industry threats.

What is the solution?

At the heart of the insurance relationship is the customer who wants choice and control in how they engage. Many insurers believe pivoting from physical to digital is the only way to manage operational costs and compete against digital native insurers. But actually, human capital is what differentiates the insurer in today’s faceless world. I believe the sweet spot lies in a hybrid of human and digital.

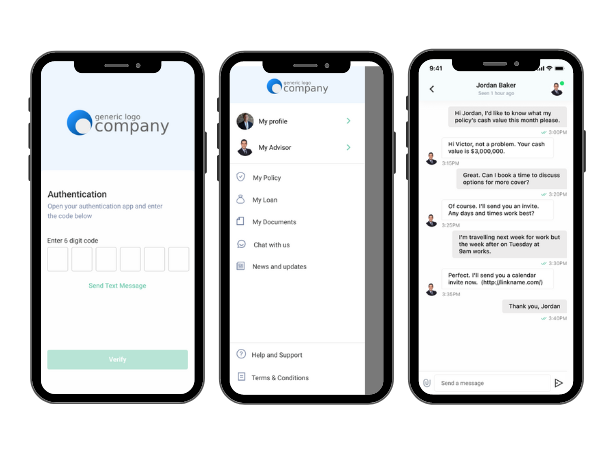

By creating a connected ecosystem between the customer and the agent, empowered by technology, the insurer can deliver a personal experience that is amplified to more customers.

What does a 'hybrid' model look like?

A hybrid distribution model that combines human and online channels is a win/win customer experience. Many have heard the expression “the right message, in the right channel, at the right time.” This is the experience customers receive in almost every other industry today. But insurance remains dominated by physical branches, call centres, paper mail and perhaps an email channel where you can expect a response in 5-7 business days.

Pivoting to a hybrid model is challenging, but it can be achieved. Leveraging data for predictive next-best actions, empowering agents with digital tools, and integrating omnichannel communication throughout the customer journey are the pillars to optimising hybrid distribution.

The successful advisor of the future is a trusted partner for customers’ financial wellbeing with technology at the core of everything they do.

Read our latest use case

Discover how we designed a digital customer wallet for a US premium financier servicing high-net-worth clients in our latest use case.