How wealth and assets managers can unlock value through digital middle and back-office transformation

Rising customer expectations for digitization is reshaping the wealth management industry. New winners are outpacing their competition by offering a superb digital end-user experience.

But a tight front-end experience demands strong back and middle office operations, making a clear case for digital transformation of those parts of the business. In fact, recent research shows 60% of customer dissatisfaction sources originate in the back office.

On top, wealth managers are facing fee compression across all client segments. Once again, middle and back-office transformation – done right – can deliver bottom-line business value, by expanding margins and simplifying workflows.

The FinTech Ecosystem makes digital transformation easier – and less costly

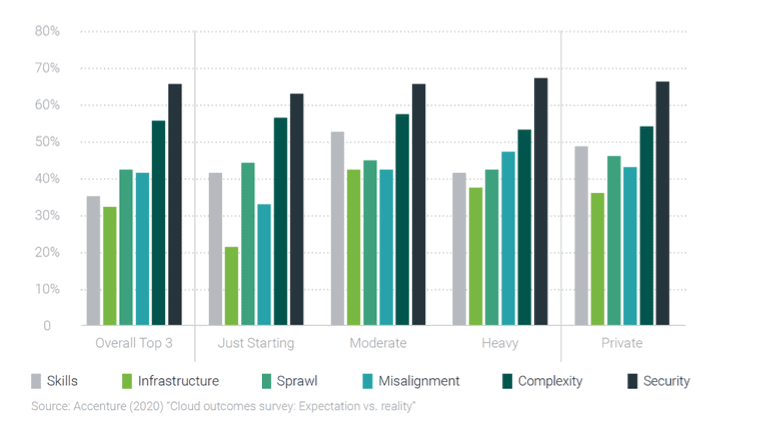

Wealth management leaders are often wary of digital transformation projects, which tend to be complex, long, and risky. A recent survey revealed two-thirds of enterprises are struggling to achieve the expected benefits from their cloud migration journeys. Most commonly, they’re held back by security and compliance risk (65%), and business and organizational complexity (55%).

In this paper, we break down the sources for this complexity, and present two case studies of recent projects, where wealth managers partnering with FinTechs have completed their transformation journey at breakneck speed, while also extracting additional business gains:

1. Transforming Securities Lending with Sharegain:

A large European asset manager was looking for an alternative securities-lending solution. Previously, they were lending securities through one of their custodian banks but felt limited by the low levels of transparency and control, which meant they couldn’t proactively capture opportunities to enhance returns.They chose to deploy Sharegain’s fully automated securities solution, which requires minimal operational involvement. With little additional CAPEX or OPEX, the asset manager was seeing return on their efforts within a few short months

2. NAV Oversight with FundGuard:

A large asset manager, managing hundreds of funds, had already outsourced its back- and middle- office operations to a third-party fund administrator (TPA), and was now looking to productize its NAV oversight function to ensure timely and accurate funds valuation.They chose FundGuard’s NAV Oversight SaaS product, which provided a wide array of out-of-the-box configurable exception checks, as well as AI-based anomaly detection. As FundGuard processed high volumes of the asset manager’s fund data, it identified more insights and anomalies than initially foreseen. On top of merely revealing errors, the implementation created great value in elevating the accounting overseer’s holistic fund activity and valuation view

FinTechs are also helping wealth managers weather the COVID-19 storm

Facing extreme volatility and heightened capital flows, with a workforce now scattered and working remotely, COVID-19 has placed wealth managers under extreme pressure.But the initial pandemic was merely the canary in the coal mine. Cyber-attacks are up 3-fold since the crisis began, and remote work conditions are creating new opportunities for bad actors to gain access to sensitive data. The report also features a special section, where we revisiting our clients and partners amid the pandemic, and witness just how resilient their solutions have proven to be.