Why financial advice is ripe for innovation, how insurers have the perfect opportunity to invest in their digital transformation and a look at how we made this happen for our client - a large life insurer in Australia.

A pivotal moment for financial advice

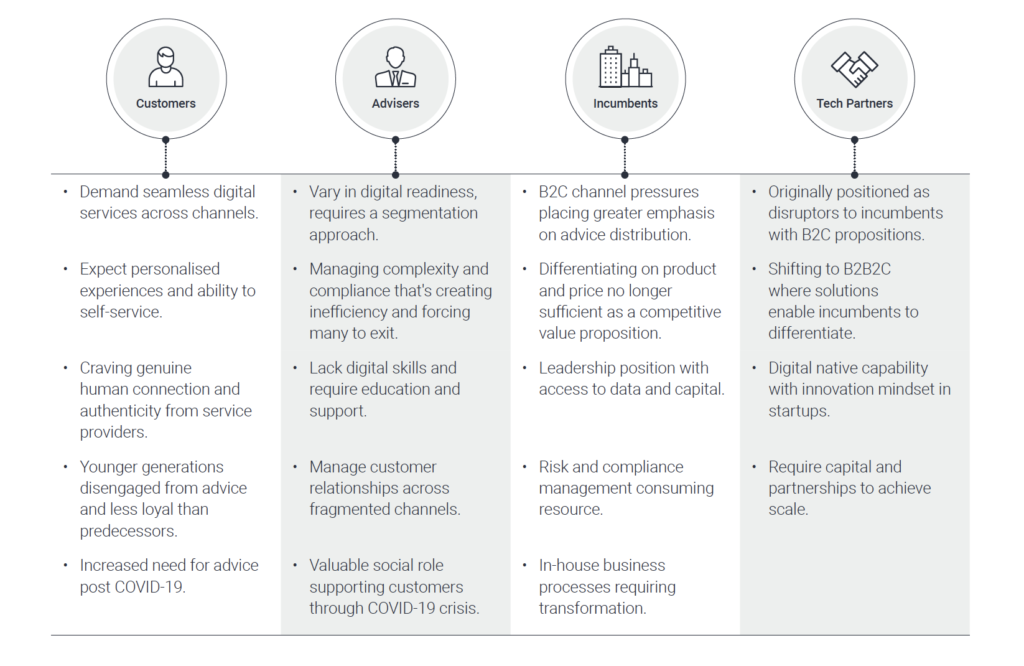

Regulation, compliance burdens and offline processes have made financial advice a costly service to deliver around the world. Combined with the fact clients now expect to engage 24/7 in an always connected digital world, the financial advice industry needs to rapidly transform to meet these new customer expectations. All players in the ecosystem – customers, advisers, incumbents, and tech partners – have challenges and opportunities in the way advice is delivered today.

Financial Adviser and Insurance Agent Distribution Today

The opportunity lies in 'solutions'

As we explored in our white paper Human Touch in a Digital World released last year, incumbents must invest in digitising processes between the adviser and client. Our client, a large life insurer, saw this as a win/win opportunity whereby investing in financial advisers meant more of their customers receiving quality advice, which included better product recommendations and customer satisfaction. A hybrid advice model where human relationships between adviser and client are enhanced with technology allows personal advice at scale.

'Digital Adviser' - A solution co-designed with our client

We began this project with the simple problem statement:

How might we enable advisers to leverage digital to better engage with always connected clients?

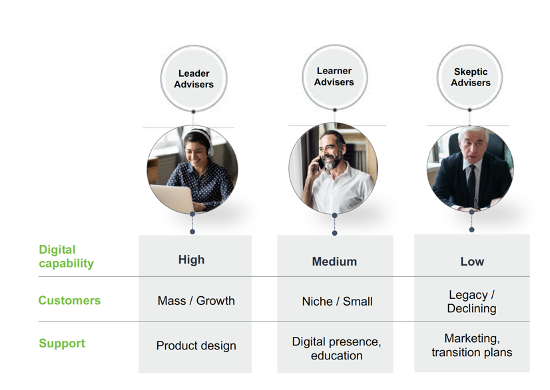

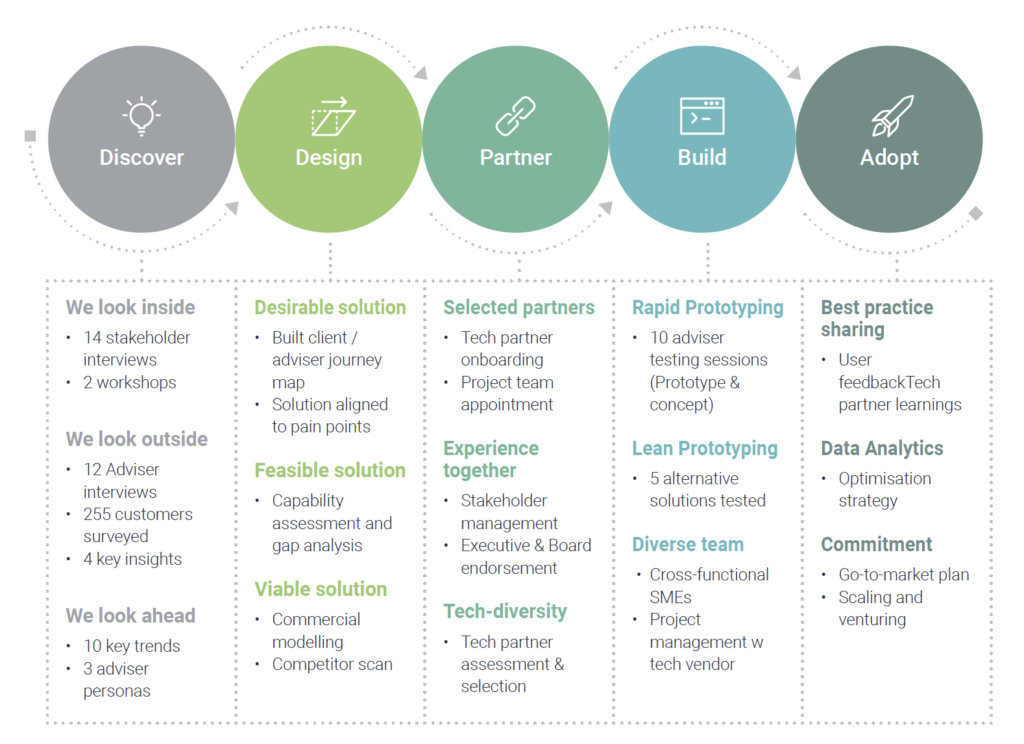

Over the course of several weeks, we worked with our client to fully immerse ourselves in the world for financial advisers through an extensive “Discovery” phase. During this research phase, our client realised financial advisers need to be segmented into cohorts to provide more tailored support to the industry. Axell’s Adviser Segmentation Model helped the client to bring this strategic thinking to the project.

We then brought our own expertise working on similar projects in other regions to co-design a new solution with our client. Partnering with a FinTech allowed the concept to go through a series of rapid prototyping that allowed the concept to be validated with adviser and the business. By building the proposition using the agile project methodology we were able to move from POC to pilot in a matter of months.

Axell’s Innovation Engagement Model

Building a hybrid solution for advisers

By understanding clients and advisers want to engage digitally but not lose the human touch to the experience, we were able to design a hybrid engagement model. Our solution allows advisers and clients to enjoy an omnichannel experience across the lifecycle, but without losing valuable connectivity and data in the process. Also, the platform provides advisers with high-quality content that can be shared with clients anytime, anywhere.

The response from financial advisers using the platform has been overwhelmingly positive and the new solution is now being scaled out across the industry.

For our client, they have created strategic value in the form of new access to data, improving advice efficiency, and driving client acquisition and retention via advisers. Ultimately, the ambition is to grow the advice market to ensure its long-term sustainability – a challenge the insurer has positioned themselves as leading for the industry.

Read more on the project in our use case.