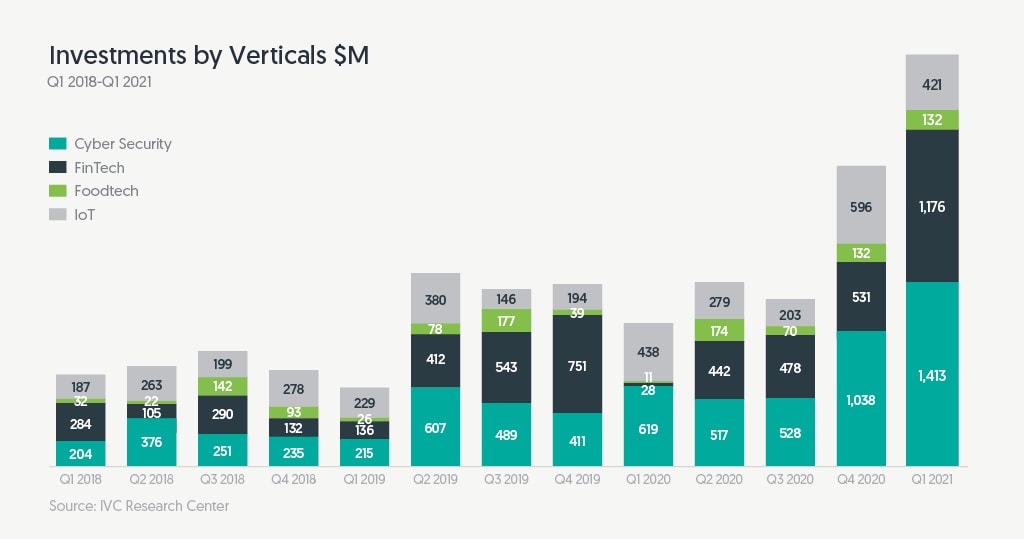

The world’s “Start-up Nation” has cemented its position as a global leader of tech innovation, raising over $5.37 billion in investments in Q1 2021.

Global investors have thrown their support behind emerging Israeli tech with the region receiving over $5.37 billion in funding across Cyber Security, FinTech, FoodTech and IoT verticals in the first quarter of 2021.

FinTech on target for record breaking year

Israel’s FinTech was a particularly strong performer with funding totalling $1.18 billion in the three months period – a 120% increase on the previous quarter.

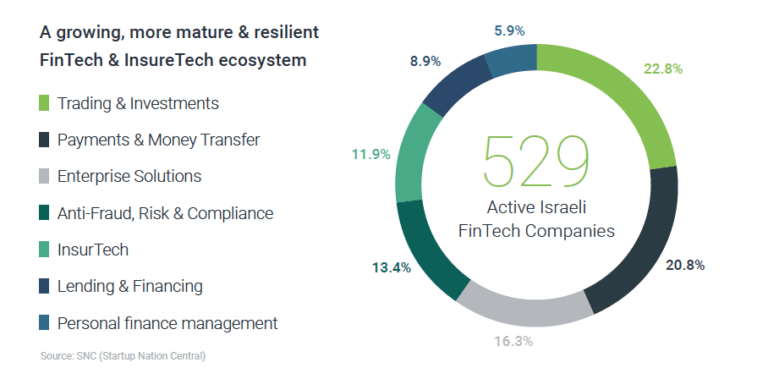

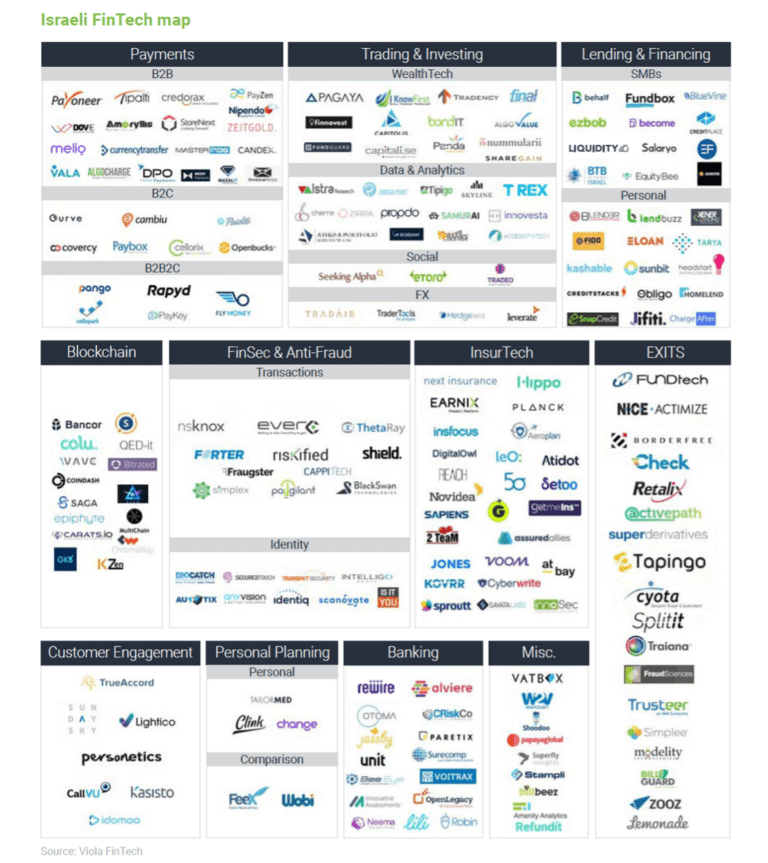

There are over 529 active FinTech start-ups in Israel across a broad spectrum of sub-sectors, including payments, InsurTech, trading and investments, and personal finance.

From strength to strength

Our new Israel FinTech Report 2020 showcases the ecosystem’s strong performance in 2020. FinTech had over $1.6 billion in investment across 65 deals in 2020 – despite the world being crippled by a pandemic that continues to slow economies.

Israeli FinTech owes its COVID resiliency to being B2B focused, which often requires long-term contracts and has lower marketing costs.

Why Israel?

With a unique culture, strong economy, government backing and globally connected ecosystem, Israel has established itself a world-leader in emerging tech.

Home to over 6,000 start-ups and hundreds of multinational R&D centres, the “Start-up Nation” has fostered a hotbed of innovation and collaboration to scale new ventures and encourage investment.

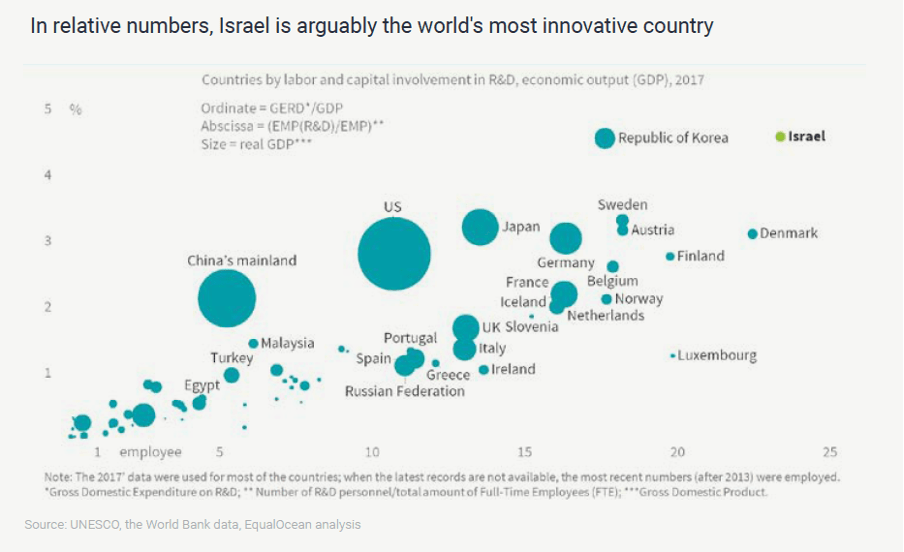

In fact, Israel is considered the world’s most innovative country with the highest amount of R&D expenditure per capita at over 4% of GDP – the average of OECD nations is 2%.