Accelerating digital transformation in insurance

The past two years has seen unprecedented digital transformation fuelled by the pandemic changing consumer and business behaviour. While insurance has traditionally lagged in digital adoption, many global players have accelerated strategic digitisation programs to keep pace with the change.

Over the next year, insurance can expect to follow in the banking sectors’ footsteps with embedded and open insurance gaining traction. New opportunities to digitise distribution channels, creating networks and leveraging data will be the insurers competitive advantage. At a macro level, the year ahead will see rising global debt and increasing climate change risk presenting strategic challenges and opportunities to optimise long-term business sustainability.

A Snapshot of the Top 10 Macro Insurance Trends

Below we summarise the 10 major drivers of change in insurance around the world.

For a deep dive analysis of these plus our predictions for fintech trends, download our latest report.

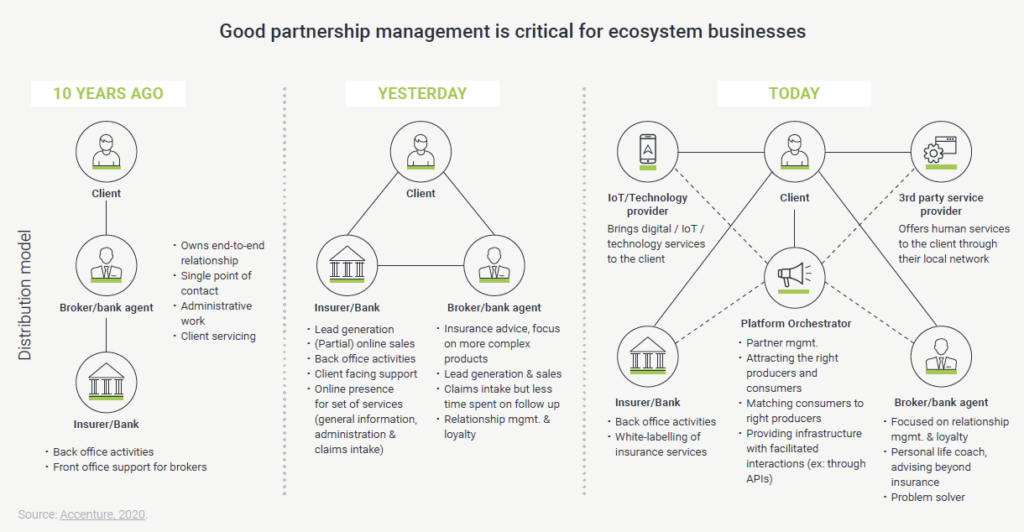

Creating ecosystems with third parties to build new offerings, improve the customer experience and reduce reliance on vertical integration.

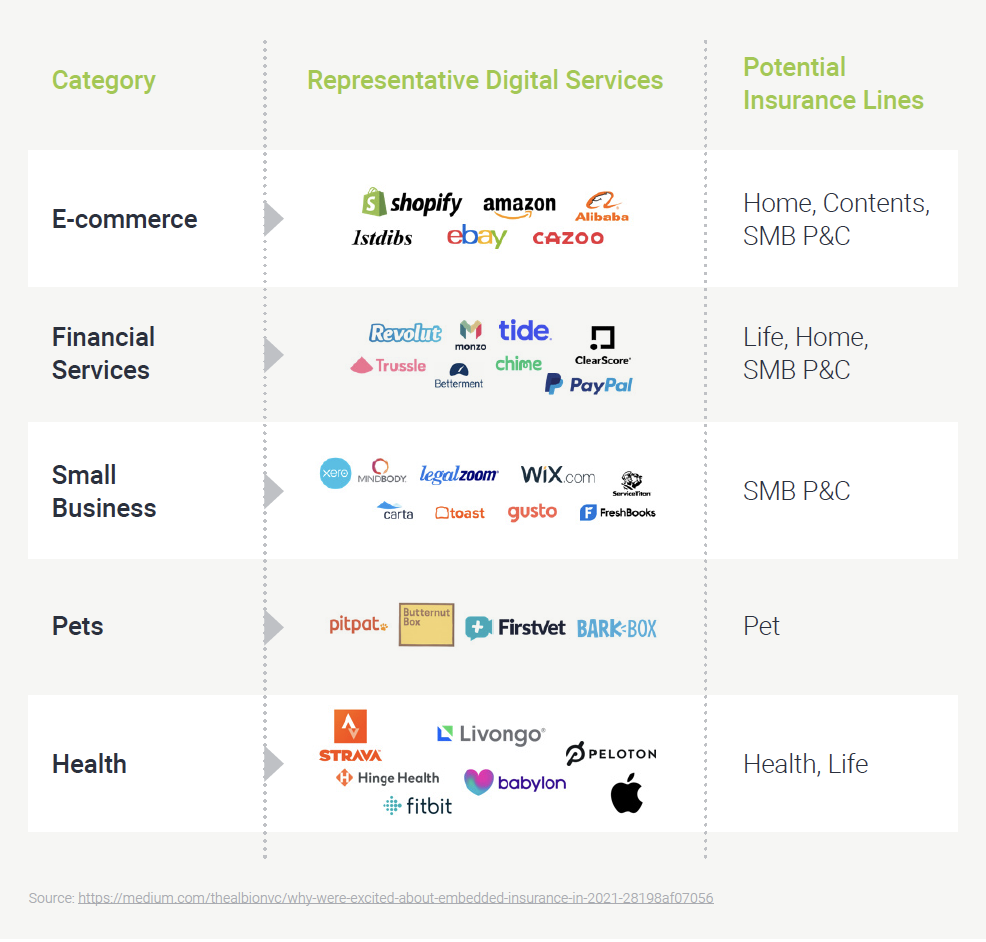

Insurers can reach more customers by embedding insurance propositions in digital channels that are regularly engaged with by prospective customers.

Insurers must now provide compelling career pathways, benefits, and flexibility to attract new talent and retain high-performing employees.

Investing in sustainability initiatives as a strategic and purposeful decision to mitigate future risk of climate change impacts to existing insurance business models.

Customers have taken on large debts fuelled by access to cheap credit and rising living costs, resulting in greater protection needs.

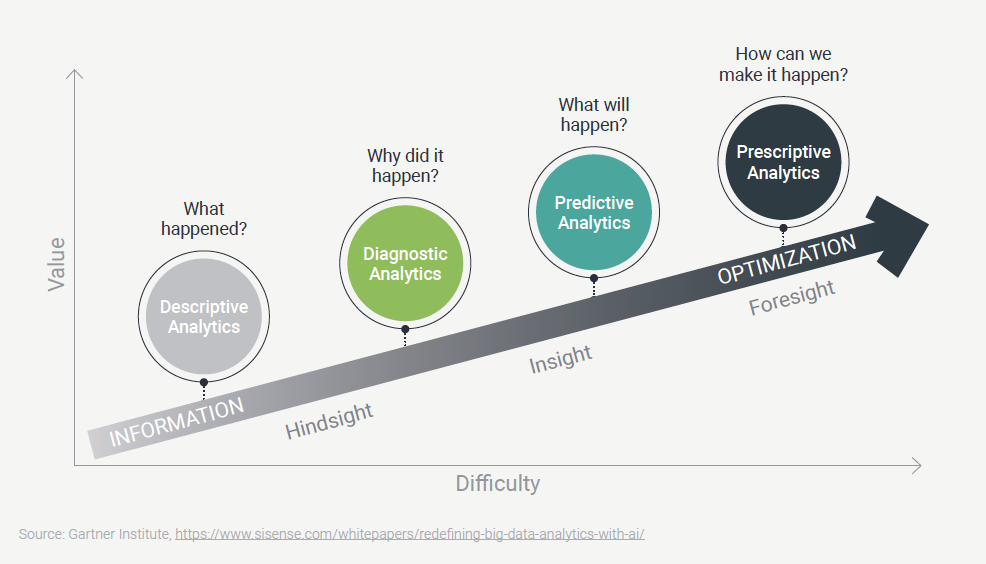

Leveraging AI and machine learning will allow insurers to deliver the best-in-class experience now expected by the customer.

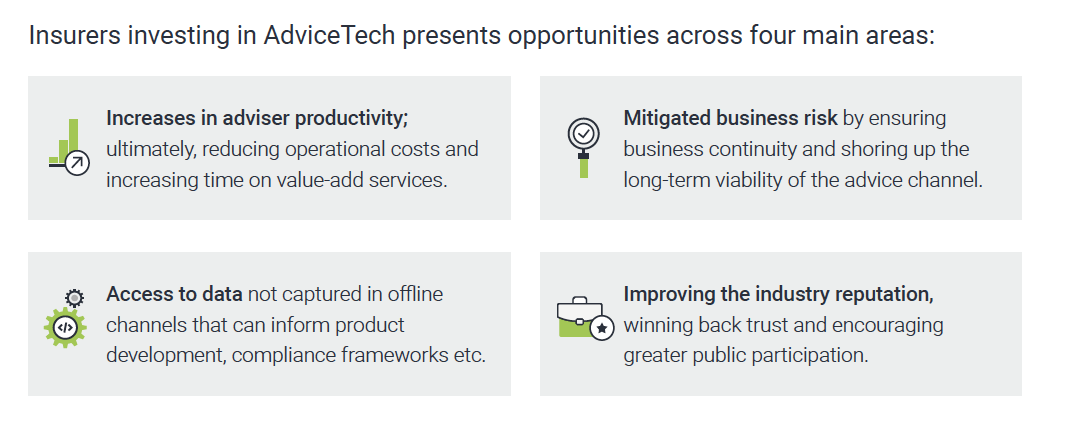

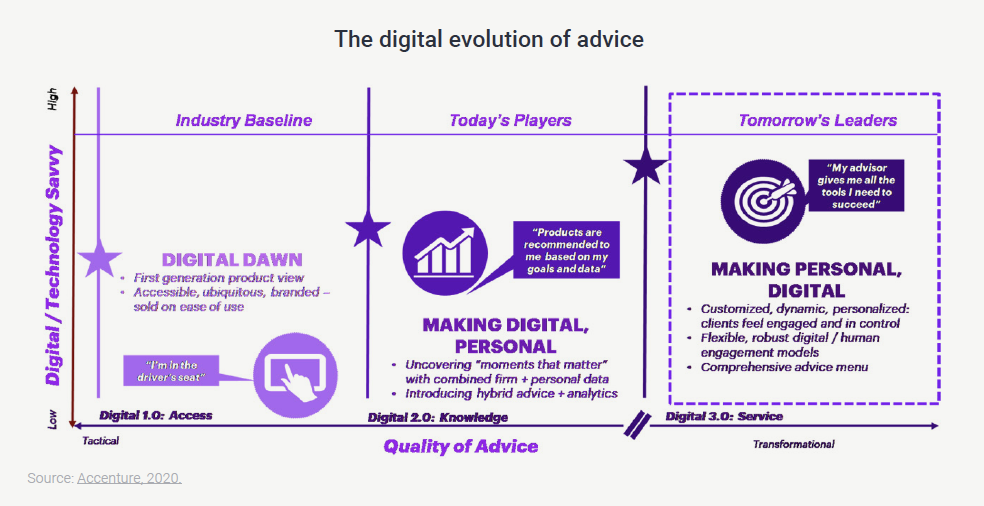

Incumbents can a create strategic advantage by digitally empowering their network of agents, which facilitates data collection that can be used to optimise distribution and proposition design.

Agents can improve operational efficiency and amplify the human aspect of their service – a key strategic advantage of traditional insurers over digital competitors.

Building bespoke pricing and modular products for customers that manage their health to attract healthier lives.

New digital investment vehicles available to the masses have created B2C wealth opportunities.