"We want to bring digital innovation into the business, but don't know where to start."

It’s a problem I’m all too familiar with. When I was Head of Digital Innovation at Generali (the world’s 6th largest insurer), I was in charge of redesigning new value proposition and introducing new technology into the company.

From experience, large financial companies – insurers, wealth managers, banks – have lots of moving parts. It’s far from obvious where innovation gains can deliver the most benefit.

As a result, leaders often get stuck between a rock and a hard place: can’t afford to ignore digital innovation; but worried of over-investing in useless technology.

Today, I’d like to show a case study of how financial services companies can resolve this conflict, moving from the wide, general scope of “digital innovation” to specific, value-adding solutions.

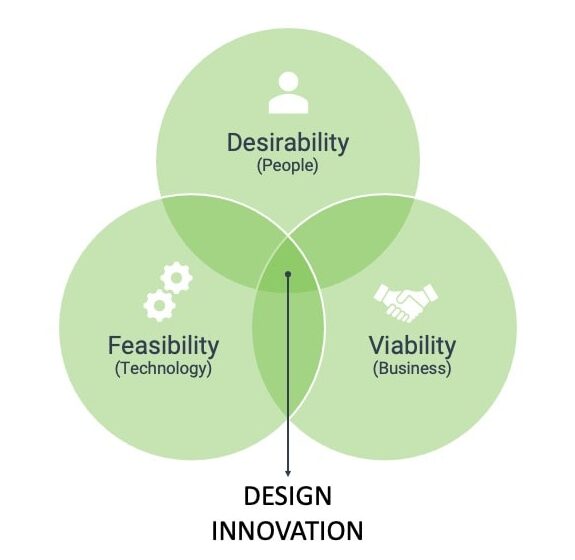

At Generali, I became a big fan of the human-centered Service Design methodology for designing new processes and services, and selecting the right technology partners. This approach has two distinct features:

- It starts with the client – not the solution or technology. A customer-centric approach is essential to spot unmet needs. Immersing in the client mindset will also tell you how to introduce innovation, which helps when choosing your technology partners.

- It’s a cross-organization effort.For a smooth client experience, every part of the business has to get involved at an early stage. Limiting the conversation to a small part of the business won’t create the internal buy-in and operational efficiency you’ll need. It’s particularly critical in insurance where traditionally the underwriters are “building” the products.

One of our clients is an auto-insurance company. Right now, the industry is rushing to release apps that monitor clients’ driving patterns, and use the data to tailor solutions to car-owners’ needs.

But competition is rife, and our client wanted to create a genuine new product to set them apart.

It starts with listening

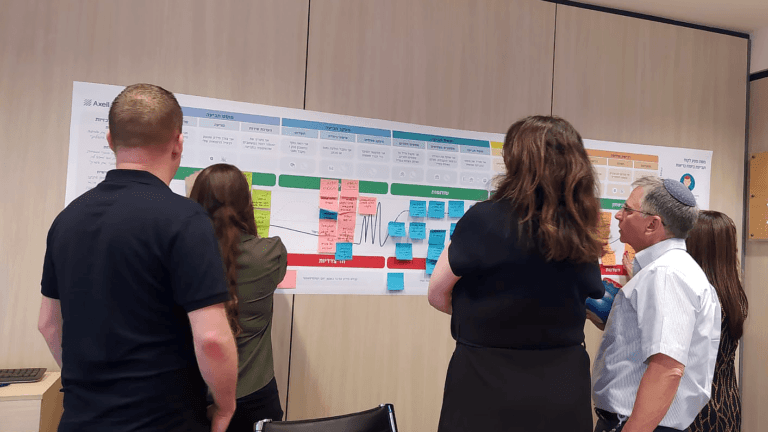

We brought in stakeholders from every department for joint brainstorming sessions in a series of Design Thinking workshops. We wanted to identify what the company already does well, and where its employees see market gaps.

Separately, we interviewed end-clients. Holding a focus group with policy buyers, we sought to learn their car-use habits and policy-purchasing choices.

Unsurprisingly, the initial research yielded a number of opportunities. There isn’t one holy grail for digital innovations; the challenge is to choose your projects wisely. In this case, where we saw the biggest gap was with young drivers:

- Existing solutions attach the policy to the vehicle, not the driver. High premia usually mean young-drivers’ insurance is attached to one specific vehicle. This proved an annoyance for families owning more than one vehicle.

- Existing solutions offer coverage only if the young-driver remembered to activate the policy before driving. The risk of forgetting to act is a source of anxiety for both young-drivers and parents.

From idea to solution

While scoping the problem, we dug deep into the pain point, by interviewing both young drivers – and their premia-paying parents. What were each of the two groups’ wants? What were their concerns?

We found, for example, young drivers had no problem with smart sensors monitoring their driving. And both groups expressed relief and excitement at the prospect of an always-on policy.

Psychology also comes into play: Young adults usually don’t pay for insurance, and want to feel they’re contributing. They loved the thought of reducing premia for their parents through safe driving.

Through these conversations, a solution began to emerge:

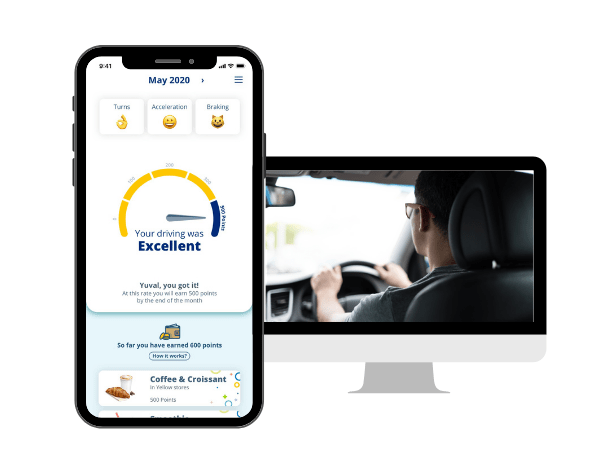

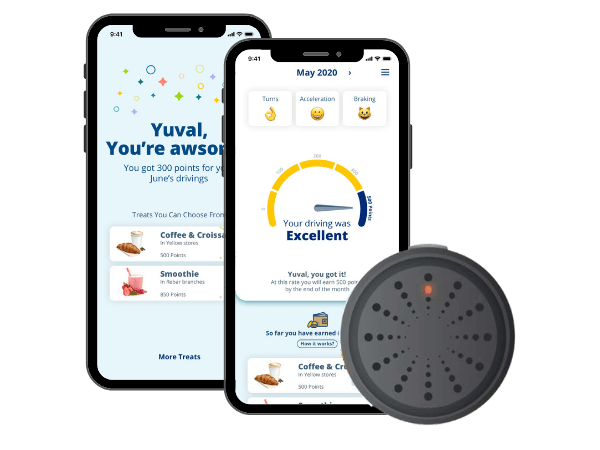

- Smart Sensors:

– When purchasing a policy, clients receive a sensor they attach to the vehicle/s. The sensors are easy to install and activate. - The Young-driver App

– Young drivers are rewarded monthly for good driving, with points they can redeem at selected businesses.

– Based on the data collected, they get tips to help them improving their driving – and score more points.

– It’s an always-on policy. The app recognises when they’re driving, and can identify multiple sensors. - The Parent App

– Parents can keep track on how safely young drivers are driving.

– The app offers easy access to insurance services such as claims and customer services.

This solution has been rolled out successfully and is proving a commercial success. And the company got exactly what it wanted: real differentiation in a crowded market – through digital innovation.

Your three takeaways

- Patience has to come from the top

The entire process, from initial exploration to commercial product, took almost two years.

Initially, I was concerned the teams might lack the patience required to develop a customer-centric product.

But this client had the right mindset. With the leadership of their CEO and their head of Innovation we were able to get the teams’ patience. Once the ball was rolling it was clear to everyone this was the most direct route to a successful project.

- Clients are your portal to innovation

I’ve always believed it’s important to co-create new products and services with clients. This process was remarkable in showing us just how many unknow unknows there are. It was only through the process of discovery, alongside the clients, we learned not just where the pain points are, but what gets clients excited – a big feat for insurance!

3. Being taken hostage by your org-structure

Insurance companies are typically product-oriented: You’ll have departments for car insurance, property insurance, life-insurance. Then you’ve got your marketing and sales, but they too are product oriented.

Your clients don’t care one bit about your org-structure. They just want something that solves a problem, and their experience is ultimately funnelled into a single spot: their mobile screen.

Read the use case

For more information, discover the details of the challenges, opportunities and solutions of motor insurance project .

About Axell

We’re innovation builders for insurance and financial services firms. Our innovation hub sits at the intersection between insurance and financial services companies as well as the tech industry.

We have a proven track-record of co-creating products and services with some of the largest financial services companies around the world. Our core is built on connecting our clients to progressive startups as we deliver an agile ecosystem that benefits all of its members.

Looking to introduce digital innovation into your company?