In a world where technology continues to evolve at an unprecedented pace, financial advisors are facing a paradigm shift in their roles. In particular, the rise of generative AI has sparked conversations about how it will reshape the financial advisory landscape. Will technology replace human financial advisors, or will their roles evolve to complement these advancements? Let’s explore the future role of financial advisors in the age of generative AI.

The Evolution of Financial Advice

Traditionally, financial advisors have played a crucial role in helping people make informed financial decisions. They provided personalised guidance, curated investment portfolios, and offered expertise in financial planning at different life stages. However, with the advent of generative AI, these roles are undergoing a massive transformation.

Generative AI, powered by advanced algorithms and massive datasets, can analyse and predict market trends with remarkable accuracy. It can also generate investment strategies, identify risks, and recommend optimal portfolio allocations. As a result, financial advisors are no longer the sole bearers of financial expertise. Instead, they are becoming facilitators of a more complex financial ecosystem. This means rapidly up-skilling in new areas, such as technology, to stay ahead of the curve.

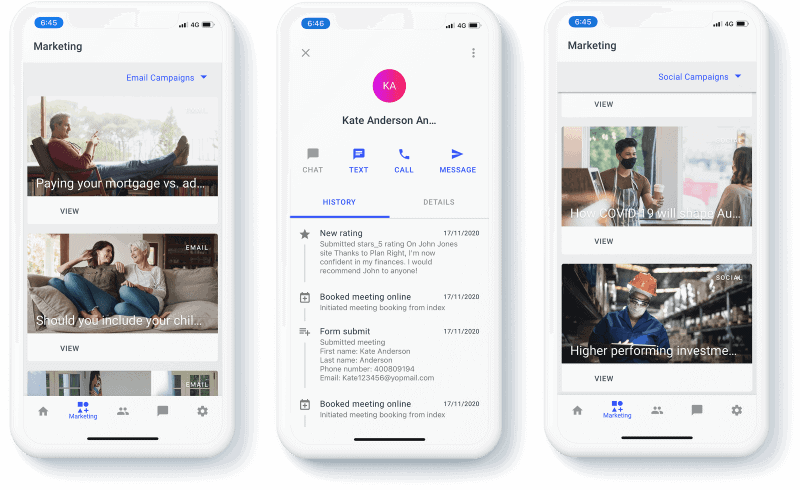

It’s not just AI changing the advice landscape. Digital tools have enhanced the client experience by improving accessibility via self-servicing capabilities. Clients are now empowered with chatbots that provide instant support and basic financial guidance. Online portals and mobile apps allow instant access to their investment portfolios and insurance policies so they can transact and claim at their convenience. This rise of the “self-directed client” means advisors need to be strategic partners with their clients, rather than coordinators or administrative support.

The Hybrid Approach

One possible future for financial advisors is embracing a hybrid approach with generative AI systems. Rather than seeing AI as a threat, advisors can leverage AI tools to enhance their services. AI can handle data analysis, track market changes in real-time, and provide personalised investment options. Advisors can instead focus on understanding their clients’ unique goals, risk tolerance, and life circumstances.

This collaborative approach allows financial advisors to spend more time building strong client relationships as their strategic partners. By getting AI to work for them rather than against them, financial advisors can provide a holistic financial planning experience. This combines the best of both worlds: the analytical prowess of machines and the emotional intelligence of humans.

Personalised Financial Planning

Generative AI excels at processing large amounts of data for tailoring financial plans to individual clients. It can analyse a client’s financial situation, goals, and preferences to create customised investment strategies. Therefore, financial advisors, empowered by AI, can offer more personalised advice than ever before.

However, human advisors bring a personal touch that algorithms and automation cannot replicate. The ability to build trust, and establish long-term relationships are fundamental aspects of successful advisory services. A good advisor provides reassurance, emotional support and personalised guidance that goes beyond the capabilities of technology.

Personalised Financial Planning

Generative AI excels at processing large amounts of data for tailoring financial plans to individual clients. It can analyse a client’s financial situation, goals, and preferences to create customised investment strategies. Therefore, financial advisors, empowered by AI, can offer more personalised advice than ever before.

However, human advisors bring a personal touch that algorithms and automation cannot replicate. The ability to build trust, and establish long-term relationships are fundamental aspects of successful advisory services. A good advisor provides reassurance, emotional support and personalised guidance that goes beyond the capabilities of technology.

The Future is Bright

The future role of financial advisors is not about being replaced by technology; it’s about evolving alongside it. Generative AI is a powerful tool that can enhance the capabilities of financial advisors, allowing them to provide more personalised, holistic, and ethically grounded financial advice to their clients. The hybrid approach, where AI handles data analysis and process automation, while advisors focus on strategy, emotional support and ethical considerations, represents a promising path forward.

In this age of rapid technology evolution, financial advisors who adapt and embrace AI will likely thrive. By leveraging the strengths of machines and bringing their human touch, advisors can continue to play a vital role in helping clients navigate the complexities of the financial world.

How we created a digital advice platform with an Australian insurer

Our use case explores how we partnered with a life insurer to research, design, and deliver a digital client engagement tool for financial advisers.