While we believe machines won’t replace humans entirely, it’s clear that professionals need digital skills to stay competitive and add value to their clients. There’s been much discussion around hybrid financial advice – a combination of human and digital. But what does this look like in practice?

We look at a hypothetical day in the life of a financial adviser who uses digital tools to streamline their work, enhance the client experience, and stay updated.

Morning

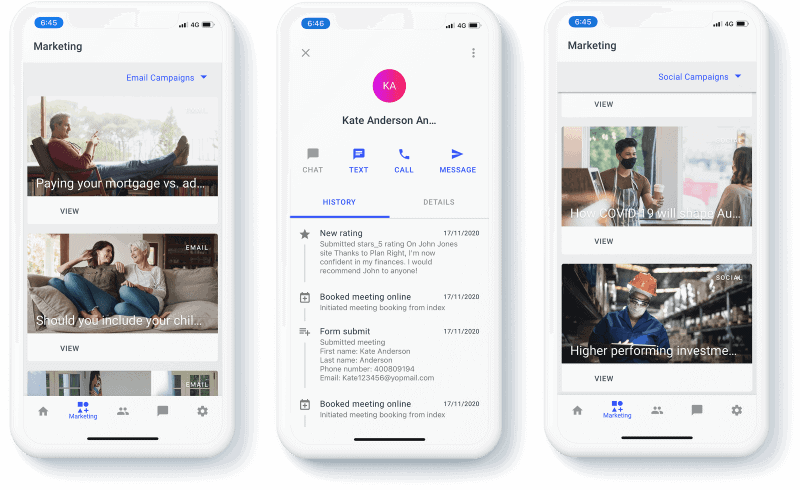

- Client Communication: The adviser starts their day by checking communications from clients and colleagues. They use a multi-channel messaging tool with CRM integration to schedule meetings, respond to inquiries, and share important updates. Routine enquiries, i.e., transaction history requests or policy renewal dates, are responded to via an AI-powered virtual assistant. This frees up time for more complex client interactions.

- Client Relationship Management (CRM) Software: The adviser checks their CRM for AI-generated recommendations of tasks to follow up, client messages to send, and acquisition and retention opportunities. All client interactions across all channels are recorded in the CRM for easy compliance reporting.

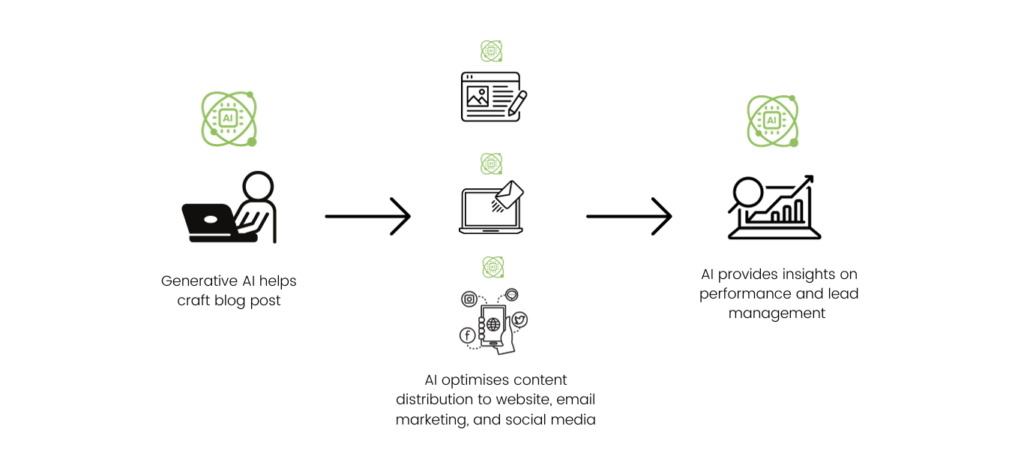

- Content Marketing: The adviser uses generative AI to quickly draft a blog article and LinkedIn post about preparing for tax time. After some simple edits, it gets published on the website and shared via a social media distribution platform.

Midday

- Portfolio Adjustments: Based on AI-driven recommendations and market analysis, the adviser adjusts their client portfolios.

- Client Meetings: The adviser meets with a client in person. During the meeting, AI-generated presentation materials and reports are used to illustrate advice strategies. AI recording tools take notes from the meeting and share them with the adviser and to the CRM.

Afternoon

- Financial Planning & Analysis Tools: Following the client meeting, the adviser uses financial planning tools to perform in-depth research on investment opportunities, and insurance options, analyse market data, and generate recommendations.

- Client Onboarding and KYC: A new client is onboarded entirely digitally. Sensitive documents are securely emailed to the client who verifies their identity and signs electronically. This AI-powered and automated Know Your Customer (KYC) procedure ensures compliance with regulatory requirements while removing any manual handling for the adviser. Check out how we built a digital onboarding process for one of our clients.

Evening

- AI Reporting Tools: The adviser uses AI-generated reports to provide clients with updates on their portfolio performance, investment recommendations, and market insights. These reports are personalised for each client, considering their unique financial goals and risk profile. The adviser adds their own personal message to each based on the last client interaction.

- Client Engagement: The adviser sends personalised messages and updates to clients based on AI-generated insights. These messages may include educational content, market outlooks, happy birthday messages or reminders about upcoming financial planning milestones. Check out how we built a digital client engagement platform for financial advisers.

- Lead management: The adviser sends AI-generated responses (with personal edits) to new lead enquiries from the morning’s blog post. The lead details are automatically added to the CRM and a task is created for the adviser to follow up in a few days.

End-of-Day

- Task Management Apps: The adviser reviews their AI-generated task list and adjusts priorities and timeframes based on their planned work schedule.

- Education: The adviser may spend time researching and staying updated on advancements in AI and financial technology to ensure they are leveraging the latest tools and strategies to benefit their clients.

- Data Security Software: Across all digital platforms, the adviser uses encryption tools, multi-factor authentication, and other security software to protect sensitive client information and comply with regulatory requirements.

Summary

Advisers now need to be much more than just financial experts. They need to be relationship builders continually looking at ways to automate and digitise processes that enhance their efficiency, personalisation, and ability to provide data-driven advice to clients. Upskilling in digital tools allows financial advisers to focus on being strategic partners to their clients and making well-informed investment decisions while reducing the burden of routine tasks and administrative work.

How we created a digital advice platform with an Australian insurer

Our use case explores how we partnered with a life insurer to research, design, and deliver a digital client engagement tool for financial advisers.