The COVID-19 pandemic increased demand for financial advice, adding significant pressure to an industry already grappling with challenges. Amid these evolving dynamics, financial services corporations must take ownership of engaging advisor networks, ultimately preserving the essential human touch they bring to client relationships.

In this blog post, we’ll delve into our groundbreaking behavioural science model, developed in collaboration with an AI-driven human intelligence platform. We’ll demonstrate how this innovation equips industry incumbents with the tools they need to cultivate a deep understanding of both advisors and their clients.

Financial advice is in high demand

The economic uncertainty that has arisen from COVID-19 has resulted in many people around the world turning to financial advisors for help. For financial advisors, it’s meant they’re now busier than ever as they help clients in their moment of need. Empathy and compassion from advisors are critical in building and maintaining client relationships during this time.

General Manager of Retail Distribution, Niall McConville from Australia’s largest life insurer, TAL has witnessed this in the market’s independent network of advisors. “My experience over the last six months as we’ve worked through COVID and started to see the impact on the unadvised is just how powerful clients have found the relationships with their advisers. It’s given them a lot more certainty, it’s someone they can go to and talk to them about what’s going to happen.”

Emotionally, this takes a toll on financial advisors who were already under pressure prior to COVID-19. Worldwide, advisors have been struggling to find time balancing changes to regulations while keeping up with the time-intensity of serving clients. It’s causing a mass exodus in some markets, like Australia where it’s predicted up to 40% of advisers will leave the industry before 2023. While in emerging markets like Asia, attrition of new advisor recruits has become a huge and costly challenge to the industry.

To avoid burnout and retain an engaged workforce of advisors, incumbents need to take an “advisor-centric” approach to their networks.

It's not "one size fits all"

In the past, insurers and wealth managers have looked at their advice networks as one bucket. I’ve seen in working with my clients around the world how this approach creates generalisations about all advisors, such as “they’re resistant to change” or “they don’t like to use digital”. However, this misses a valuable opportunity to personalise the support to advisors.

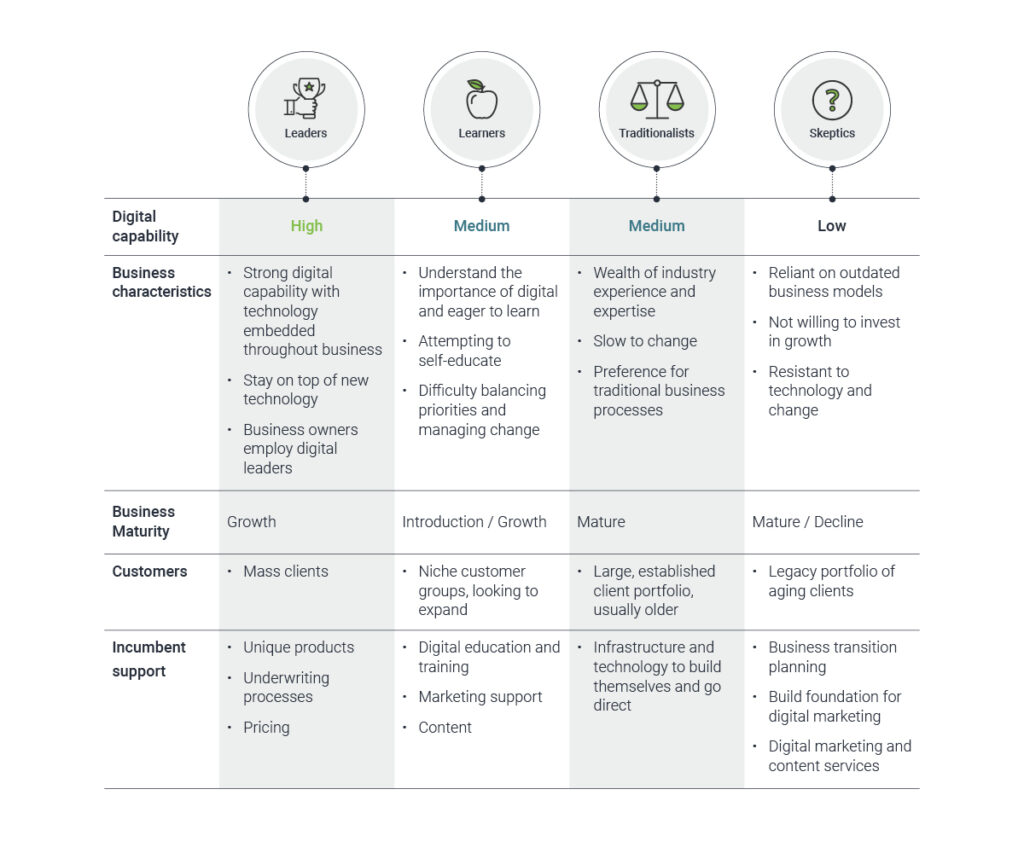

This was why we created the Axell Advisor Segmentation Model (see below), which we launched in our global research report earlier in the year. It allows incumbents to be strategic in how they support advice networks to get more from the network.

It’s important when segmenting advisors is to look beyond demographic characteristics, like gender or years of experience. The new way is to combine these with psychographic models to develop a deeper understanding of advisors to deliver the right tools, resources, education and training.

The Power of Personality

In the business world, behavioural science is the new dimension in understanding human thoughts, emotions and behaviours. However, while it’s being used for customer segmentation, little is still known about segmenting large networks of employees or professionals, particularly financial advisors.

That’s why we recently partnered with the award-winning human intelligence and AI solution, BestFit. They’ve designed a simple, yet powerful personality profiling tool based on Nobel Prize-winning academic research that avoids respondent bias with indirect questioning. Together, we’ve built a Strategic Advisor Personality Model that can be scaled to large advisor networks.

BestFit’s Founder, Sonja Kohn says it is critical businesses take action to build a better understanding of human emotions, thoughts and motivations in today’s world.

“COVID-19 has transformed ways of working together, forever. While there have been positives of remote working, we’ve seen how employee engagement and morale are suffering from disconnection. An updated assessment of agents’ state of mind allows companies to transform challenges into opportunities.”

Unlike traditional personality assessments, the questionnaire itself is designed to maximise engagement by minimising the time investment – requiring just a few minutes to complete.

The model measures advisor personality predispositions across a range of key categories to cluster them into cohorts.

It provides incumbents data and personalised communication strategies for each cohort and can be applied from the recruitment stage through to maintaining engagement in established advisor networks.

Happy Advisor, Happy Customer

By maintaining a network of engaged and productive advisors, incumbents are able to ensure clients are getting the best possible service. This has a dual benefit in reducing advisor attrition while also improving client retention. In the recruitment stage, it identifies churn risk to reduce turnover of new hires.

Financial advisors have never been more important in providing human connection and support to client who need them more than ever. Incumbents need to invest in new ways of providing personalised support to advice network now and into the future.